Issue 1 - Does it apply to me? Which products does it cover?

There are critical differences between applicability on which products it applies to:

UK: HS Code 2709 and 2710

US: HTSUS Code 2709

In short, both include crude and petroleum oils and oils obtained from bituminous minerals; but the UK has extended it to: preparations not elsewhere specified or included, containing by weight 70% or more of petroleum oils or of oils obtained from bituminous minerals, these oils

being the basic constituents of the preparations; waste oils. Includes HSFO, VGO, Kerosene.

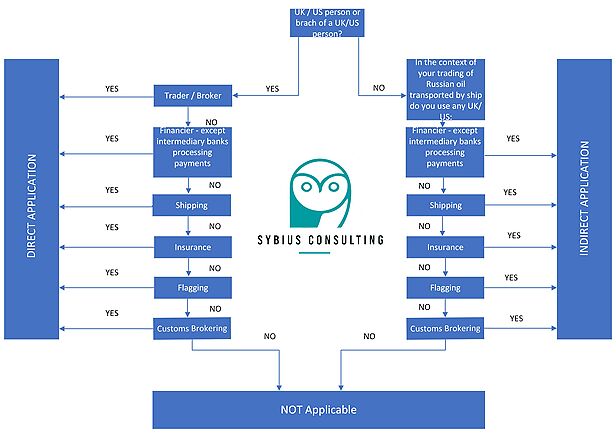

Both available guidance documents agree on the applicability of the Oil Cap, at least to whom the oil cap applies to:

Individuals: any US/ UK Nationals anywhere in the world

Companies: Any US / UK companies, including branches of those companies or companies operating in the US/UK

Remember your service providers. Trade and shipping Brokers, Banks, Financing companies, Ship owners, Insurance providers, Flag states and Customs Brokers are all covered by these requirements.

If you use any services provided by UK, US or EU service providers, the requirements will apply to you indirectly as it applies to them.

We have included a quick reference flowchart to help you navigate.

Issue 2- When does the cap apply? When does it not?

Believe it or not, there are differences between each guidance on when the applicability of the Oil Price Cap stops!

What they agree on:

The start date of the prohibition and, therefore, of the obligation on the Oil Price Cap is the 5th of December 2022 at 00:01h EST / 05:00 GMT

If Goods are loaded before the above date and times AND are unloaded before 19th of January 2023 at 00:01h EST / 05:00 GMT – then the Oil Price Cap does not apply

The Oil Price Cap ceases to apply when the product is outside Russia and is substantially transformed, basically refined to be transformed into a different product.

What they disagree on:

The Oil Price Cap ceases to apply when the oil passes through customs controls in a third country.

The Oil Price Cap ceases to apply the moment that the oil passes through customs controls in a third country AND is either sold inland or substantially transformed. The Oil Price Cap still applies if merely passing through customs and re-exporting via “maritime transport”.

We would expect that the UK and US guidance converged over time, but for now, this is the letter of what they say.

Issue 3- Safe Harbours – What is required?

Now we turn to how to ensure you conduct your business within the “Safe Harbour”- Key concepts: Documentation and Due Diligence.

What is a Safe Harbour?

These are the conditions, that if followed in good faith, shield service providers from strict liability in a situation where they are unfortunately party to a breach of sanctions.

How does this apply to the Oil Price Cap?

All actors in the service supply chain will need to demonstrate that the underlying Oil / Product transactions adhere to the Oil Price Cap

How does it work?

Service providers are divided into three “tiers” of actors, depending on their access to pricing information.

Tier 1: Those with direct access to price information such as Traders and Brokers:

Tier 2: Those who can have access to pricing information such as financial institutions, ship/vessel agents, and customs brokers:

Tier 3: Those who can have access to pricing information such as financial institutions, ship/vessel agents, and customs brokers:

What documents are required? See the below diagram….

????But wait – is there more?????

Yes, Due Diligence. Both UK and US guidance includes a due diligence requirement. Companies relying on the safe harbour are required to conduct “sufficient due diligence” to “satisfy themselves” on their ability to reasonably rely on any attestations received.

Issue 4 - Record Keeping & Reporting – Is it all the same?

We wrote about Safe Harbours and now we discuss Record Keeping and Reporting Are there any differences ??

OFSI guidance: This is the most prescriptive of the available guidance. We have copied the list of documents at the bottom of the post.

The retention period for documentation – at least 4 years beyond the end of the calendar year. This applies to attestations, trading documents are not specifically named. We assume usual tax requirements apply

OFAC guidance: This is less prescriptive but does have its quirks. As we mentioned before, remember that OFAC requires that Shipping, Customs and Insurance costs are “invoiced separately”. Careful with your Incoterms.!

Retention period for documentation – at least 5 years although trading documents are not specifically named. We assume usual tax requirements apply

OFSI Reporting – Tier 1 Actors have 30 days to report their transactions, subject to the general license.

But what about Tier 2 and Tier 3? – You have an obligation to check with your Tier 1 counterparties that they have done their reporting or report themselves. We hope everyone’s KYC is up to date and includes UK person and US person categorisation flags.

Issue 5 - What are the sanctions involved?

Monetary Sanctions and how to prevent them

Let’s start by showing the money! UK's guidance puts a maximum of 1 Million Sterling fines or 50% of the estimated value of the breach, with a maximum always of 1 Million Sterling. US' Guidance does not go into much detail, so we assume the usual breach of sanctions penalties will apply.

Helpfully, the UK has stated that there is a way to avoid sanctions if an entity is found to have dealt with Russian Oil above the Price Cap:

-> Demonstrate to the OFSI that they have fulfilled the requirements of the Attestation (see the section - Record Keeping & Reporting – Is it all the same?)

-> Undertake sufficient Due Diligence to satisfy themselves of the reliability and accuracy of the information provided by Tier 1 if relying on this documentation. We warned you in Safe Harbours – What is required? – it was not just clickbait!

And this concludes our series on the Oil Price Cap. This is it. THE END

But wait…. Just one more thing! The EU has not published any guidance yet, we hope that they will do it, and we will be there to help you through it.

As you will undoubtedly know, the EU has announced that they want a cap of $60/bbl and the G7 $65-70/bbl ???? they will have to be aligned, but we are still waiting.

If you want more information or guidance with the Oil Price Cap, please get in touch with us at info@sybiusconsulting.com.